Crypto Trading Analysis: Strategies for Success

In the ever-evolving world of cryptocurrency, proper analysis is crucial for traders looking to capitalize on market movements. The potential for profit in this space is enormous, but so too is the risk. This article aims to explore various strategies and analytical frameworks you can employ for successful trading. As you dive into the intricacies of crypto trading, Crypto Trading Analysis click here to enhance your understanding of the broader financial landscape.

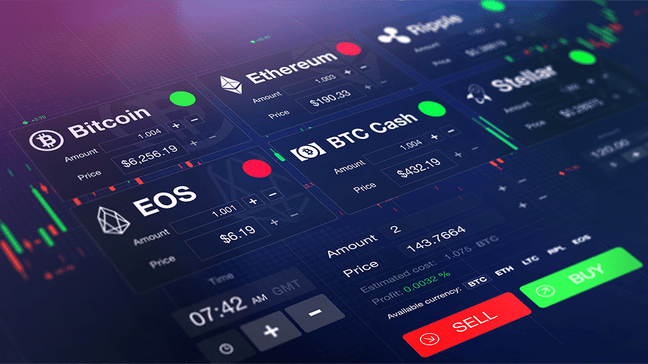

Understanding the Crypto Markets

The cryptocurrency market operates 24/7, making it highly volatile compared to traditional stock markets. Prices can swing dramatically in a short period, leading to opportunities as well as significant risks. Traders often find it challenging to navigate these tumultuous waters without a solid trading analysis approach.

Market Sentiment Analysis

Market sentiment often drives short-term price movements in the crypto markets. Public opinion, news headlines, and social media trends can all exert influence on traders’ actions. By utilizing sentiment analysis tools and resources, traders can gain insight into the collective mood of the market. Tools such as social media sentiment trackers and news aggregators can help identify bullish or bearish trends before they become apparent in price movement.

Technical Analysis

Technical analysis (TA) focuses on statistical trends derived from trading activity, such as price movement and volume. It is an essential tool for any trader, whether they are day trading, swing trading, or investing for the long term. Several key indicators can assist in technical analysis, including:

- Moving Averages: These indicators smooth out price action to identify trends over a specific period.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. An RSI value above 70 may indicate an overbought condition, while a value below 30 may indicate an oversold condition.

- Bollinger Bands: These bands help determine whether prices are high or low on a relative basis. When prices touch the upper band, it might be a signal to sell, while touching the lower band might be a buy signal.

Fundamental Analysis

Fundamental analysis (FA) involves evaluating a cryptocurrency’s underlying value by considering various factors such as technology, team, use cases, and market demand. It is particularly important for long-term investors looking to build a sustainable portfolio. Key aspects to consider in FA include:

- Whitepapers: A thorough examination of a coin’s whitepaper can provide insights into the technology and vision behind the project.

- Development Activity: Analyzing GitHub repositories and the frequency of updates can signal a project’s viability and potential.

- Partnerships and Adoption: Strategic partnerships and increasing adoption can dramatically alter a cryptocurrency’s market value.

Risk Management in Crypto Trading

Risk management is a critical component of successful trading. Due to the volatile nature of the cryptocurrency market, effective risk management strategies can mean the difference between profitability and loss. Here are a few strategies worth considering:

- Position Sizing: Determine how much of your capital you are willing to risk on a single trade. This often boils down to percentage risk, commonly advised at no more than 1-2% of your total trading capital on any one trade.

- Stop-Loss Orders: Implement stop-loss orders to automatically close out losing positions. Setting these orders helps to curtail potential losses if the market moves against you.

- Diversification: Spread your investments across different cryptocurrencies to minimize risk. This can stabilize your portfolio and protect you from significant losses in a particular asset.

Understanding Market Cycles

Cryptocurrency markets, like any financial market, undergo cycles of growth and contraction. Recognizing these cycles can enhance a trader’s ability to make informed decisions. The typical market cycle can be broken down into four phases: accumulation, markup, distribution, and markdown. Understanding where the market currently sits in this context is key to developing a strategic trading plan.

Tools and Resources

To engage effectively in crypto trading analysis, various tools and resources are available to traders. Some popular platforms include:

- TradingView: A comprehensive charting tool that provides technical analysis capabilities and social networking for traders.

- CoinMarketCap: This website offers real-time data on the price, market capitalization, and volume of various cryptocurrencies.

- Crypto News Aggregators: Websites like CryptoPanic and Coindesk provide real-time news alerts and updates that can impact market conditions.

The Role of Psychology in Trading

Psychological factors play a significant role in trading performance. Emotions such as fear and greed can lead to poor decision-making. Recognizing these psychological traps is vital for maintaining discipline and sticking to your trading strategy. Setting clear goals, maintaining a trading journal, and practicing mindfulness can help offset these peaks and valleys in emotional states.

Conclusion

Cryptocurrency trading presents a wealth of opportunities, but it also requires a strategic approach rooted in robust analysis. By employing a combination of market sentiment analysis, technical and fundamental analysis, and sound risk management practices, traders can navigate this volatile landscape effectively. Continuous education and adaptation to emerging trends are crucial for long-term success in the cryptocurrency trading arena. Ultimately, a well-rounded trading strategy, supported by thorough analysis and psychological resilience, will empower traders to make informed decisions and capitalize on the dynamic world of crypto trading.